Get to know Carrie Atkinson and learn about your Medicare options for 2025

In general, part A covers:

Inpatient care in a hospital

Skilled nursing facility care

Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care)

Hospice care

Home health care

https://www.medicare.gov/what-medicare-covers/what-part-a-covers

Part B covers two types of services:

Medically necessary services. Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practices.

Preventive services. Health care to prevent illness or detect it an an early stage, when treatment is most likely to work best.

You will pay nothing for most preventive services if you get the services from a health care provider who accepts assignment.

https://www.medicare.gov/what-medicare-covers/what-part-b-covers

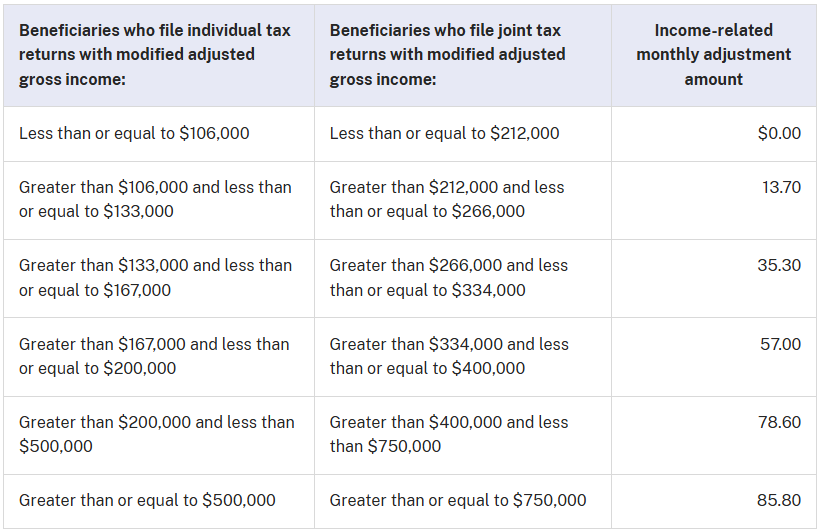

Income-related monthly adjustment amount (or IRMAA for short) is a surcharge added to your Part B and Part D premiums if your income is above a certain level. IRMAA is based on your modified adjusted gross income, and the Social Security Administration uses a two-year look-back of your income tax returns. The amount is recalculated annually, and appeals can be filed if you disagree with their decision.

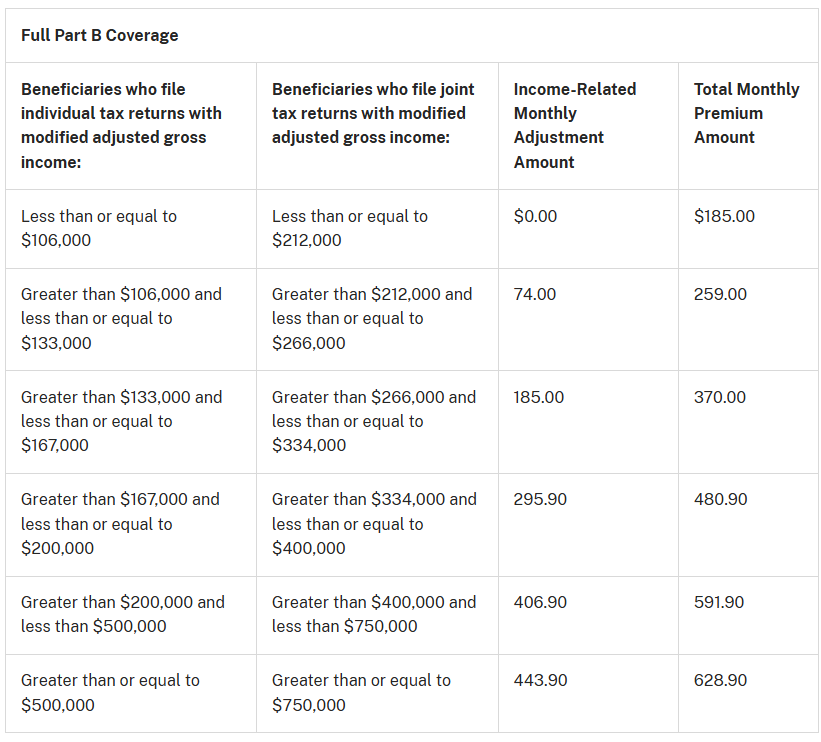

The 2025 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

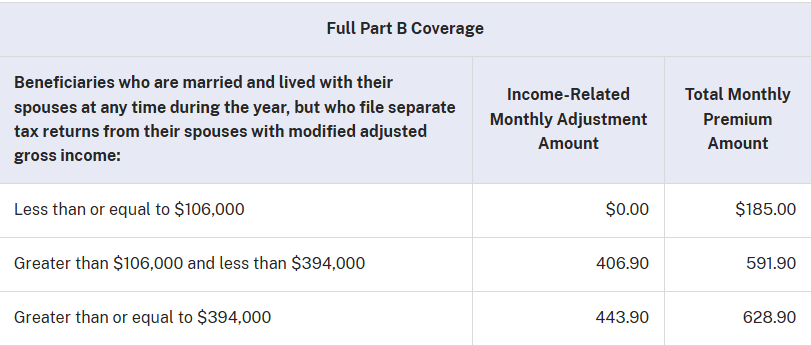

Premiums for high-income beneficiaries with full Part B coverage who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

The 2025 Part D income-related monthly adjustment amounts for high-income beneficiaries are shown in the following table:

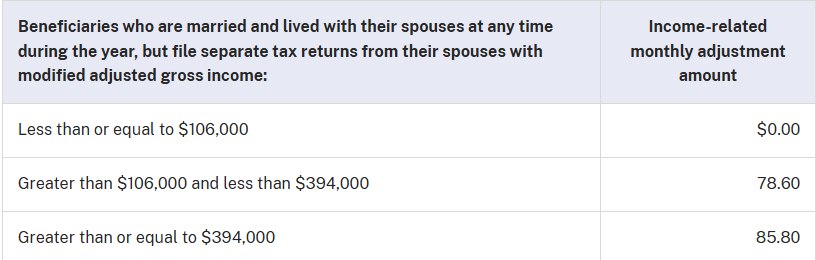

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

Generally, Medicare drug plans and Medicare Advantage Plans with drug coverage have 3 stages:

Deductible stage: If your Medicare plan has a deductible, you pay all out-of-pocket costs until you reach the full deductible. No Medicare drug plan may have a deductible more than $590 in 2025. Some Medicare drug plans don’t have a deductible.

Initial coverage stage: After you reach your full deductible (if your plan has a deductible), you’ll pay 25% of the cost as coinsurance for your generic and brand-name drugs until your out-of-pocket spending on covered Part D drugs reaches $2,000 in 2025 (including certain payments made on your behalf, like through the Extra Help program). Then, you’ll automatically get “catastrophic coverage.”

Catastrophic coverage stage: You won’t have to pay out-of-pocket for covered Part D drugs for the rest of the calendar year.

When you have Medicare drug coverage, you’ll get an Explanation of Benefits (EOB) the month after the pharmacy bills your plan. Your EOB shows the prescriptions you filled, what your plan paid, what you and others have paid, your coverage stage, and what counts toward your out-of-pocket costs and your total drug costs.